MANDATORY:

Starting from 1st January 2026, all businesses with annual turnover between RM1 to 5 million .

- Malaysia LHDN, June 2025

e-Invoice Malaysia Compliant ERP system: How Odoo Can Help

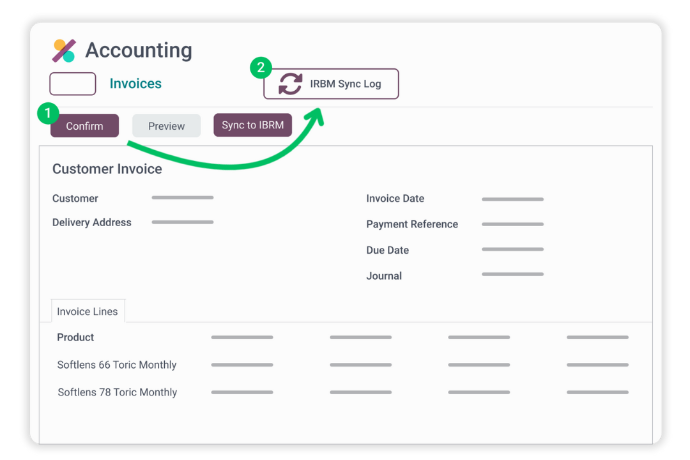

Odoo ERP is fully compliant with Malaysia IRBM's e-invoicing guidelines and regulations. Odoo's e-invoicing is easy to implement, and even easier to use. You can simply create a new invoice, and sync it to IRBM with just a single click. All your e-invoices' validation statuses will be auto-populated in a comprehensive list view too.

To ensure you have a sustainable, reliable e-invoicing solution, we ensure your Odoo ERP system is up-to-date and fully compliant with LHDN's e-invoice regulations and standards.

e-Invoicing Solution Main Features

e-Invoice Validation Simplified

Auto IRBM Validation Submission

With our e-invoicing solution, your e-invoice validation process can be easily automated.

All you have to do is click "Confirm", and your confirmed invoice will be automatically submitted for validation.

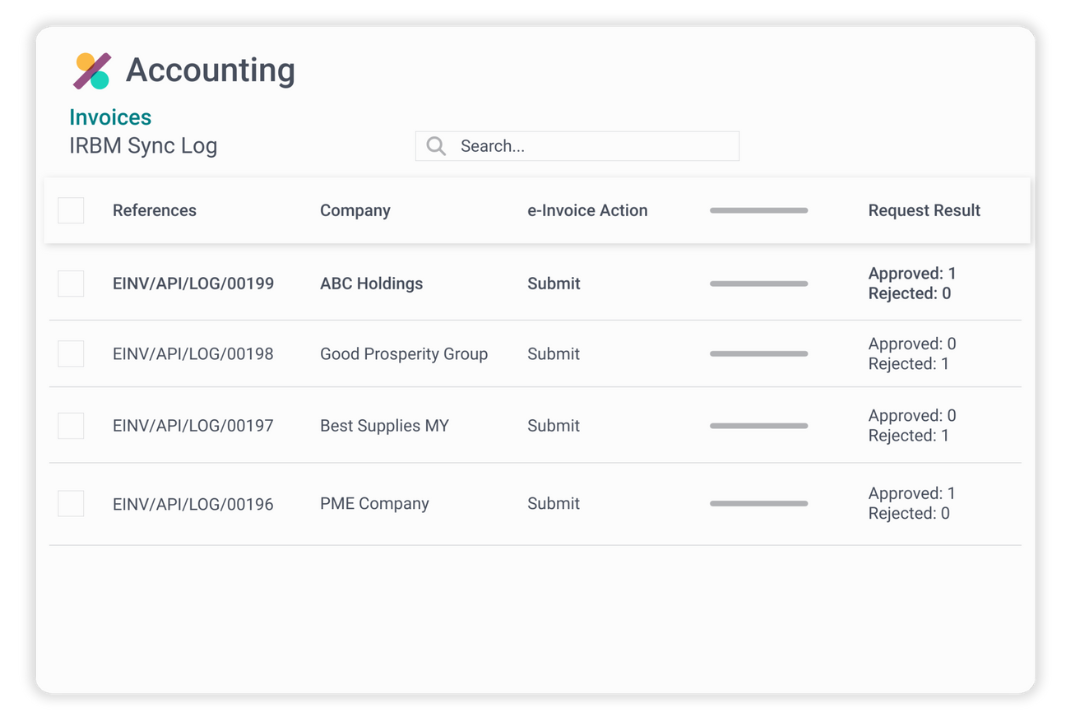

e-Invoice Approval Status In A Single View

IRBM Sync Log

Our IRBM Sync Log feature allows businesses to check all their e-invoices' approval status, in a single comprehensive view, without having to visit the MyInvois Portal manually.

Other important information such as invoice references, related company names, e-invoice actions, and more can be viewed as well.

e-Invoicing solutions do not have to be complicated!

Let our team of experts guide you

Why Choose Onnet Consulting

Malaysia e-Invoicing Solution Provider

LHDN Malaysia announced on March 2023 that all businesses with turnover exceeding RM100 million must implement e-invoicing starting 1st August 2024, while businesses with a turnover between RM25 million to RM100 million, will have to implement e-invoicing starting 1st January 2025.

As Malaysia's most trusted ERP system provider, we are committed to helping you make the transition to e-invoicing seamless. Having much experience in the Malaysian market, we are ready to provide any consultation and support needed for Malaysian businesses looking for e-invoice solutions.

Malaysia e-Invoicing Timeline by Phases

LHDN Introduced e-Invoice Malaysia

LHDN announced a phased plan for mandatory e-invoicing implementation for all businesses.

e-Invoice Phase 1

Starting 1st August 2024, businesses with a turnover exceeding RM100 million must generate e-invoices.

e-Invoice Phase 2

From 1st January 2025, businesses with an annual turnover between RM25 million and RM100 million must adopt e-invoicing.

e-Invoice Phase 3

Businesses above RM5 million with 6-months’ soft launch must generate e-invoices.

e-Invoice Phase 4

Businesses with annual turnover between RM1 million and RM5 million with 6-months’ soft launch must adopt e-invoicing.

e-Invoice Phase 5

Beginning 1st July 2026, all businesses with annual turnover between RM500,000 and RM1 million onwards must generate e-invoices.

e-Invoice Malaysia FAQs

We understand the mandatory implementation of e-invoicing for Malaysian businesses can be confusing to many. So here are the answers to some Frequently Asked Questions about e-invoice Malaysia!

What is e-invoice Malaysia?

e-Invoice Malaysia, as per LHDN guidelines, is the digital counterpart of a traditional paper invoice. It enables businesses to create, send, receive, and manage invoices electronically using standardized data files.

An e-Invoice in Malaysia includes 55 fields detailing the transaction, such as;

- Seller and buyer information

- Item description

- Quantity

- Price, tax

- Total amount

- Payment details,etc.

Validated e-invoices will have a Unique Identification Number (UIN) and a QR Code, generated by the MyInvois Portal, allowing for online validation. This standardized format ensures compatibility and compliance with LHDN regulations.

When does e-invoicing start in Malaysia?

Malaysia's e-invoicing implementation start date varies by business. In March 2023, LHDN announced a phased plan for mandatory e-invoicing implementation;

- Phase 1: Starting 1st August 2024, businesses with a turnover exceeding RM 100 million must generate e-invoices.

- Phase 2: From 1st January 2025, businesses with an annual turnover between RM 25 million and RM 100 million must adopt e-invoicing.

- Phase 3: Beginning 1st July 2025, all taxpayers engaged in commercial activities and new businesses from 2023 onwards must generate e-invoices.

This initiative requires all businesses registered in Malaysia to generate e-invoices for B2B, B2G, and B2C transactions.

Is e-invoice mandatory?

Yes, as announced by LHDN, generating e-invoices will be mandatory for Malaysian businesses.

Why is e-invoice implemented in Malaysia?

e-Invoicing in Malaysia is a key initiative by the Malaysian government to boost the digital economy and enhance the efficiency of the country's tax administration. The government has made e-invoicing mandatory for Malaysian businesses to achieve the following goals;

- Eliminate paper invoicing, which significantly contributes to tax leakages.

- Help businesses minimize costs associated with invoicing and tax compliance.

- Enable international trade by creating a wider market gap for Malaysian companies.

What are the benefits of e-invoicing implementation for businesses in Malaysia?

Implementing e-invoicing can be advantageous to Malaysian businesses. Here aresome benefits of e-invoice in Malaysia:

- Reduced Paperwork: e-Invoicing eliminates paper invoices, streamlining invoice management for both parties.

- Unified Invoicing Process: Simplifies document creation and submission, automating data entry.

- Integrated Tax Return Filing System: Generating e-invoiced ensures efficient and accurate tax return reporting.

- Streamlined Operations: Enhances efficiency, saving significant resources for businesses.

- Improved Cash Flow: e-Invoicing aims to reduce billing errors, resulting in faster payment cycles and fewer disputes.

- Digitized Financial Reporting: Aligns financial reporting with industry standards through digital processes.

- Improved Accuracy: Minimizes errors and discrepancies, saving time and effort for both parties.

Contact Us

Get more information about e-invoicing solution from our experts now