e-Invoice Compliant ERP System: Odoo Malaysia e-Invoice

Odoo ERP system’s e-invoice solution is fully compliant with LHDN Malaysia e-invoicing standards and regulations.

As businesses in Malaysia gear up for the upcoming e-invoice mandates, the need for a robust, compliant ERP system has never been greater.

e-Invoicing, a digital way of managing invoices, is becoming the new standard in Malaysia, driven by the Inland Revenue Board of Malaysia (LHDN) to enhance tax compliance and streamline business operations.

In this blog post, we'll dive into what e-invoicing means for your business, the key implementation dates to keep in mind, and why the Odoo ERP system is the ideal solution for ensuring your business remains compliant.

What is e-Invoicing?

e-Invoicing, or electronic invoicing, is the process of issuing, receiving, and storing invoices in a digital format. In Malaysia, e-invoicing is being rolled out as part of the LHDN’s efforts to modernize the tax system, improve transparency, and reduce tax evasion.

The shift to e-invoicing is not just a trend; it’s becoming a legal requirement that businesses must comply with. This means that all invoices, once the mandates are in place, must be generated, sent, and stored electronically, following specific standards set by LHDN.

The main reason LHDN Malaysia is pushing for e-invoice compliance is to create a more efficient tax reporting system that minimizes errors, fraud, and administrative burdens on businesses.

By adopting e-invoicing, businesses can not only comply with regulations but also benefit from faster invoice processing, reduced paper usage, and better cash flow management.

Read more about e-invoicing Malaysia: https://onnet.my/blog/malaysia-odoo-erp-system-3/e-invoice-malaysia-guideline-2024-complete-e-invoice-info-for-businesses-67

Malaysia e-Invoicing Implementation Date

The transition to e-invoicing in Malaysia is being rolled out in phases, giving businesses time to adapt. Here’s a breakdown of the key implementation dates:

1 August 2024: All businesses with an annual turnover exceeding RM100 million must comply with the e-invoice requirements. This means that from this date onwards, any invoice issued by these businesses must be an e-invoice that meets LHDN’s standards. Invoices issued before this date do not need to be converted into e-invoices, but any future invoicing activities must comply.

1 January 2025: Businesses with an annual turnover between RM25 million and RM100 million will need to comply with the e-invoice requirements. This group of businesses has a few extra months to prepare, but the compliance deadline is just as crucial.

1 July 2025: All taxpayers, regardless of their annual turnover, must switch to e-invoicing. This final phase marks the complete rollout of the e-invoicing system across Malaysia, ensuring that all businesses are aligned with the new digital invoicing standards.

The phased approach allows businesses of different sizes to transition smoothly to the new system, ensuring that they have the necessary tools and processes in place to generate e-invoices that comply with LHDN’s requirements.

Implement Odoo ERP System for e-Invoicing in Malaysia

Adopting an ERP system that is fully equipped to handle e-invoicing is crucial for staying compliant with Malaysia’s new regulations. Odoo ERP offers a comprehensive solution that simplifies the e-invoicing process, making it easier for businesses to manage their invoicing needs while ensuring compliance with LHDN standards.

Here are some key reasons to consider Odoo for your e-invoicing requirements:

1. Malaysia e-Invoice Validation Simplified

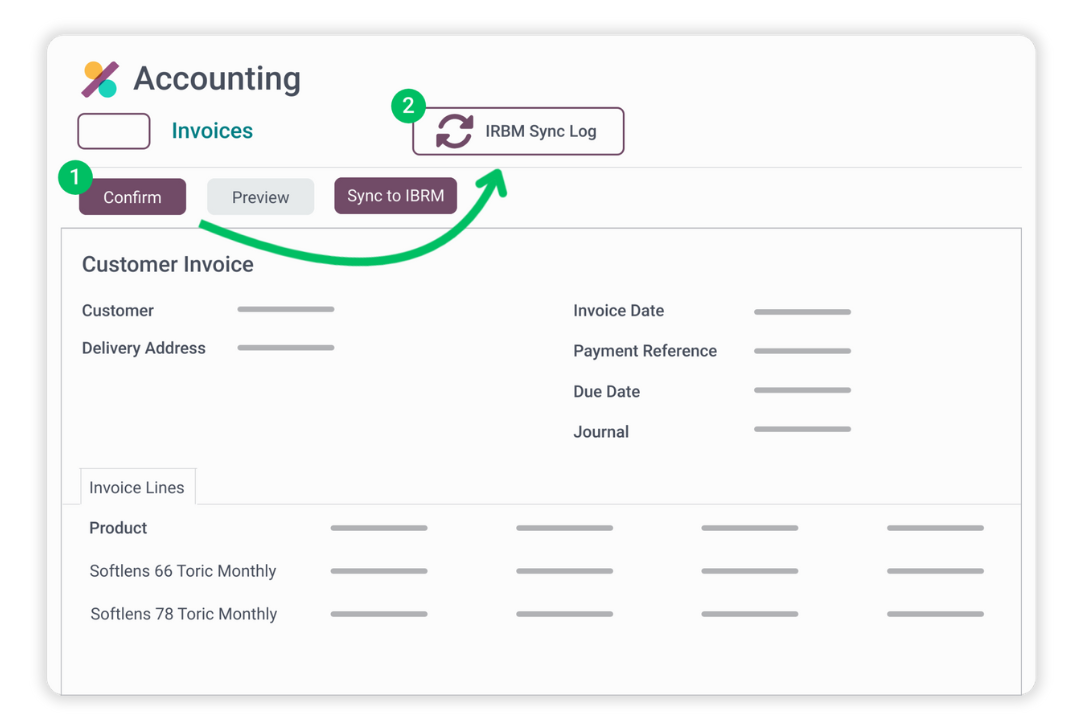

One of the standout features of Odoo’s e-invoicing solution is its ability to automate the validation process with LHDN’s IRBM system. With Odoo, the process of validating an e-invoice is as simple as clicking "Confirm." Once confirmed, your invoice is automatically submitted to IRBM for validation. This automation reduces the risk of errors and ensures that your invoices are compliant with LHDN standards, saving you time and minimizing the possibility of compliance-related issues.

2. e-Invoice Approval Status in a Single View

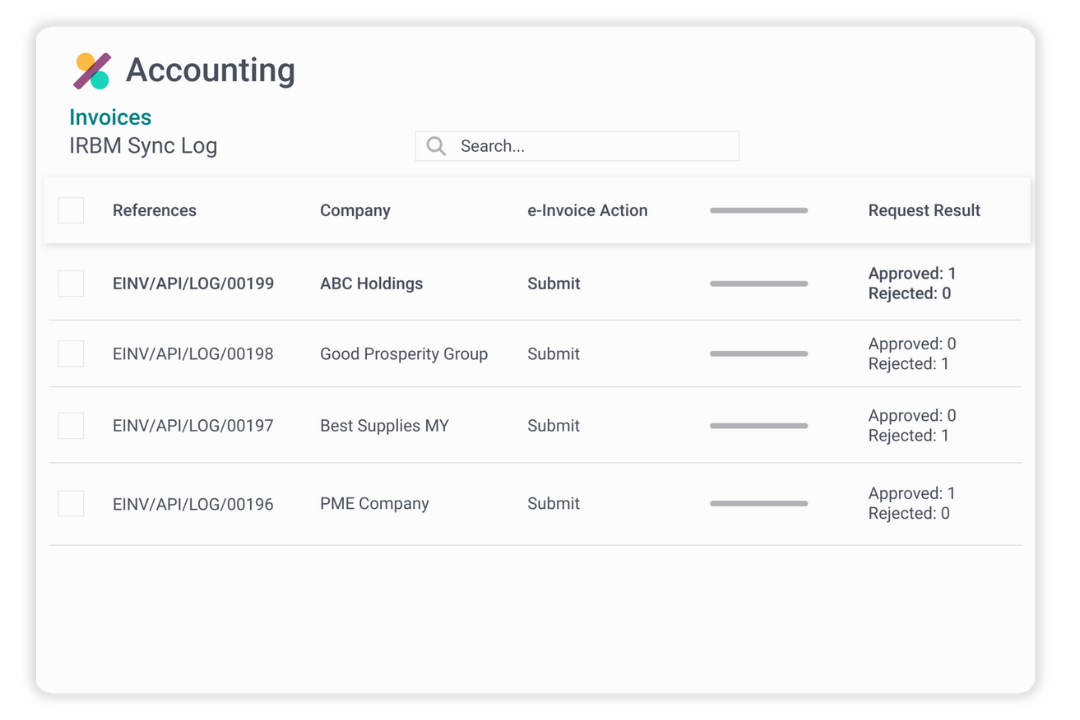

Our customized Odoo’s IRBM Sync Log feature provides businesses with a comprehensive overview of all their e-invoices’ approval statuses. Instead of manually checking each invoice on the MyInvois Portal, Odoo allows you to view all necessary information, including invoice references, related company names, and e-invoice actions, in one place. This streamlined approach not only saves time but also enhances your ability to manage your invoicing process effectively.

By implementing Odoo’s ERP system, businesses in Malaysia can ensure they are fully prepared for the upcoming e-invoice mandates, with a solution that not only complies with LHDN regulations but also optimizes their overall invoicing process.

e-Invoice Malaysia Compliant Odoo ERP System

In summary, Odoo ERP system is a great e-invoicing solution that can help Malaysian businesses make a significant step toward modernizing business operations and improving tax compliance. With the implementation dates fast approaching, it's crucial for businesses to have a system in place that not only meets the e-invoice compliance requirements but also simplifies the process.

Onnet Consulting, as an experienced e-invoicing solution provider in Malaysia, is here to help businesses navigate this transition. With a proven track record of working with global clients, we offer tailored solutions that align with LHDN’s e-invoicing standards. Don’t wait until the last minute—schedule a demo with Onnet Consulting today and see how Odoo can transform your invoicing process.