Starting in 2024, e-invoicing will become mandatory for all businesses in Malaysia in phases. This significant shift aims to streamline tax processes, improve business efficiency, and boost compliance.

In this blog post, we'll explore the e-Invoice Malaysia guideline 2024, providing complete information for businesses to navigate this new landscape.

Table of Contents:

- What is e-Invoicing in Malaysia and How Does It Work?

- When Did LHDN Malaysia Announce e-Invocing in Malaysia?

- e-Invoice Malaysia Timeline

- Is e-invoicing Malaysia mandatory?

- Who Needs to Issue an e-Invoice in Malaysia?

- Who is Not Required to Issue an e-Invoice in Malaysia?

- The Purpose of Malaysia e-Invoicing

- e-Invoicing Process in Malaysia

- e-Invoicing Model in Malaysia

- Benefits of e-Invoicing in Malaysia

- How Onnet Consulting's e-Invoicing Solution Can Help Your Business

- Onnet Consulting: e-Invoicing Solution Provider in Malaysia

What is e-Invoicing in Malaysia and How Does it Work?

e-Invoicing in Malaysia involves the electronic generation, validation, and transmission of invoices between suppliers and buyers. Unlike traditional paper invoices, e-invoices are digital records processed through a government portal in real-time.

Each e-invoice includes detailed transaction data such as supplier and buyer details, item descriptions, quantities, prices, taxes, and total amounts.

Once validated, these e-invoices receive a Unique Identification Number (UIN) and a QR code for online verification.

When Did LHDN Malaysia Announce e-Invoicing in Malaysia?

In March 2023, the Inland Revenue Board of Malaysia (LHDN) announced the mandatory implementation of e-invoicing for all businesses registered in Malaysia. This move aims to enhance tax compliance, reduce fraud, and support the country's digital economy initiatives.

e-Invoice Malaysia Timeline

The rollout of e-invoicing in Malaysia is planned in phases to ensure a smooth transition:

- August 1, 2024: Businesses with an annual turnover exceeding RM 100 million.

- January 1, 2025: Businesses with an annual turnover exceeding RM 25 million.

- July 1, 2025: All businesses, regardless of turnover.

2023

LHDN Introducted e-Invoice Malaysia

LHDN announced a phased plan for mandatory e-invoicing implementation for all businesses.

2024

e-Invoice Malaysia Phase 1

Starting 1st August 2024, businesses with a turnover exceeding RM100 million must generate e-invoices.

2025

e-Invoice Malaysia Phase 2

From 1st January 2025, businesses with an annual turnover between RM25 million and RM100 million must adopt e-invoicing.

2025

e-Invoice Malaysia Phase 3

Beginning 1st July 2025, all taxpayers engaged in commercial activities and new businesses from 2023 onwards must generate e-invoices.

Is e-Invoicing Malaysia Mandatory?

Yes, e-invoicing is mandatory for all businesses in Malaysia, phased in based on annual turnover thresholds. This mandate ensures that businesses comply with new digital tax reporting requirements set by the LHDN.

Who Needs to Issue an e-Invoice in Malaysia?

All businesses registered in Malaysia, including those with substantial transactions and turnover exceeding specified thresholds, must issue e-invoices. This includes transactions with other businesses (B2B), government entities (B2G), and consumers (B2C).

Who is Not Required to Issue an e-Invoice in Malaysia?

Certain entities and individuals are exempt from issuing e-invoices, such as:

- Government authorities

- Local and state governments

- Consular offices

- Individuals not conducting business

The Purpose of Malaysia e-Invoicing

The implementation of e-invoicing in Malaysia serves several essential purposes that align with the government’s vision for a more efficient and transparent economy.

Here’s a closer look at the main goals of e-invoicing:

Streamline Tax Administration

Enhance Business Efficiency

Ensure Accurate Tax Reporting

Reduce Tax Evasion and Fraud

Promote a Digital Economy

1. Streamline Tax Administration

E-invoicing simplifies the tax administration process by automating the generation, submission, and validation of invoices. This automation reduces the manual workload for both businesses and the Inland Revenue Board of Malaysia (LHDN). By streamlining these processes, the government can more efficiently track transactions in real-time, leading to faster tax assessments and more timely collections. Ultimately, this helps create a more organized tax system that benefits both taxpayers and the authorities.

2. Enhance Business Efficiency

By adopting e-invoicing, businesses can significantly improve their operational efficiency. The digital nature of e-invoices allows for quicker processing times, reducing delays associated with paper-based invoicing. Automated systems minimize human errors, enabling faster invoice generation and payment cycles. This efficiency can lead to enhanced cash flow management, allowing businesses to allocate resources more effectively and focus on growth and innovation.

3. Ensure Accurate Tax Reporting

E-invoicing promotes accuracy in tax reporting by providing a standardized format for all transaction records. The automatic validation of e-invoices by the LHDN ensures that businesses comply with tax regulations and that the information reported is correct. This reduces discrepancies that often arise from manual data entry and improves the overall integrity of financial data. Accurate tax reporting helps maintain a fair tax system and ensures that government revenue is properly accounted for.

4. Reduce Tax Evasion and Fraud

One of the critical objectives of e-invoicing is to combat tax evasion and fraud. The real-time validation of e-invoices allows the LHDN to monitor transactions closely, making it more challenging for businesses to manipulate their records or evade taxes. The Unique Identification Number (UIN) assigned to each validated e-invoice serves as a traceable reference, deterring fraudulent activities. By fostering a transparent environment, e-invoicing aims to enhance public trust in the tax system and ensure that all businesses contribute their fair share.

5. Promote a Digital Economy

E-invoicing is a significant step towards the broader goal of promoting a digital economy in Malaysia. By encouraging businesses to adopt digital invoicing practices, the government is laying the groundwork for further technological advancements across various sectors. A digital economy not only increases competitiveness but also attracts foreign investments, fosters innovation, and creates new job opportunities. By embracing e-invoicing, Malaysia is positioning itself as a progressive nation that values efficiency and modernization in its economic practices.

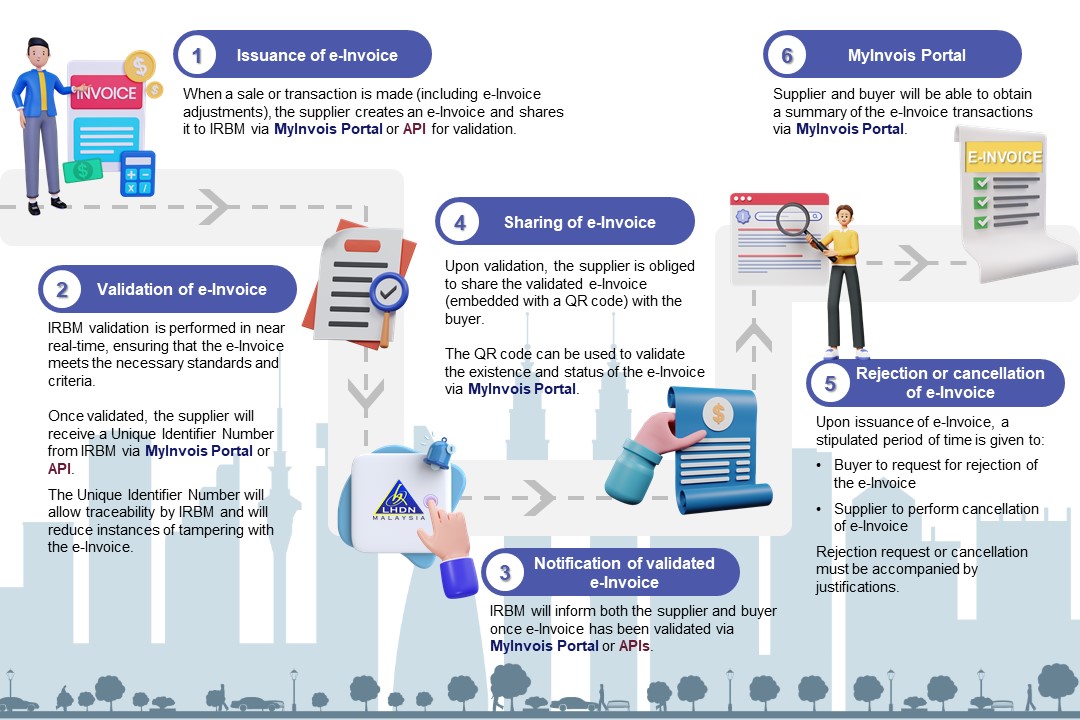

e-Invoicing Process in Malaysia

e-Invoicing Process for B2B Transactions

- Transaction Occurrence: The supplier creates an e-invoice after a transaction.

- Submission to LHDN: The e-invoice is submitted to the LHDN via the MyInvois Portal or an API.

- Validation: The LHDN validates the e-invoice and assigns a UIN.

- Notification: Both the supplier and the buyer are notified of the validation.

- Sharing with Buyer: The supplier shares the validated e-invoice, embedded with a QR code, with the buyer.

e-Invoicing for B2C Transactions

- When the Buyer Requests an E-Invoice: Suppliers gather details from the buyer and generate e-invoices in real time.

- When the Buyer Does Not Require an E-Invoice: Suppliers consolidate transactions into a monthly e-invoice for buyers who do not need an individual e-invoice.

e-Invoicing Model in Malaysia

MyInvois Portal

The MyInvois Portal is a free platform provided by LHDN for businesses to generate e-invoices manually or in bulk. It is ideal for small and medium-sized enterprises that do not have automated invoicing systems.

Application Programming Interface (API)

Businesses with large transaction volumes can integrate their ERP, billing, or accounting systems with the MyInvois system through an API. This allows for real-time, automated e-invoicing, making it efficient for handling high transaction volumes.

PEPPOL Network

A global standard for e-invoicing, the Pan-European Public Procurement Online Network supports cross-border transactions. Its adoption in Malaysia simplifies international trade and ensures interoperability between businesses worldwide.

The image below from LHDN's official website perfectly showcases the workflow of Malaysia e-invoicing:

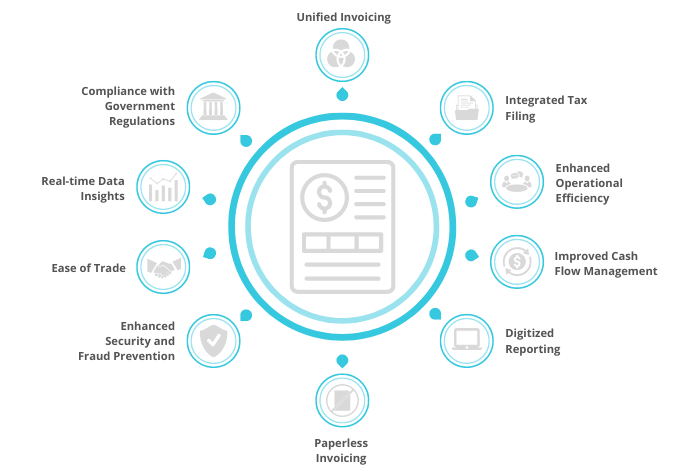

Benefits of e-Invoicing in Malaysia

The adoption of e-invoicing in Malaysia brings a multitude of advantages to businesses and the overall economy.

Here’s an in-depth look at the benefits:

- Unified Invoicing

- Integrated Tax Filing

- Enhanced Operational Efficiency

- Improved Cash Flow Management

- Digitized Reporting

- Paperless Invoicing

- Enhanced Security and Fraud Prevention

- Ease of Trade

- Real-time Data Insights

- Compliance with Government Regulations

1. Unified Invoicing

E-invoicing unifies the invoicing process by standardizing the creation and submission of invoices across all businesses. This standardization ensures consistency in the information captured, reducing discrepancies and misunderstandings between trading partners. The streamlined process makes it easier for businesses to manage their invoicing, resulting in fewer errors and disputes.

2. Integrated Tax Filing

With e-invoicing, tax filing becomes more integrated and seamless. The automated nature of e-invoices allows for real-time data transmission to the Inland Revenue Board of Malaysia (LHDN). This integration ensures that tax reports are accurate and timely, reducing the risk of penalties associated with late or incorrect filings. Businesses can rest assured that their tax obligations are met with minimal manual intervention.

3. Enhanced Operational Efficiency

E-invoicing significantly enhances operational efficiency by automating repetitive tasks. The reduction in manual data entry and paperwork allows businesses to reallocate their resources to more strategic activities. This efficiency translates into time savings and cost reductions, as fewer administrative hours are required to manage invoices. The digital workflow also speeds up the invoicing process, enabling quicker turnaround times for issuing and receiving payments.

4. Improved Cash Flow Management

One of the key benefits of e-invoicing is the improvement in cash flow management. By reducing billing errors and disputes, e-invoicing shortens the payment cycle. Businesses can issue invoices promptly and accurately, which leads to faster payment processing by customers. This improved cash flow stability allows businesses to better manage their finances, invest in growth opportunities, and reduce their reliance on external financing.

5. Digitized Reporting

E-invoicing aligns financial reporting with modern digital standards. The digitization of invoice data facilitates easy access and retrieval of financial information, simplifying auditing and compliance processes. Businesses can generate comprehensive financial reports with ease, providing valuable insights into their operations. This alignment with digital standards also ensures that businesses remain competitive in an increasingly digital marketplace.

6. Paperless Invoicing

The shift to e-invoicing eliminates the need for paper-based invoices, contributing to environmental sustainability. By reducing paper consumption, businesses can lower their environmental footprint and contribute to corporate social responsibility goals. Additionally, the reduction in paper use minimizes storage and handling costs associated with physical documents, further streamlining business operations.

7. Enhanced Security and Fraud Prevention

E-invoicing enhances the security of financial transactions by utilizing advanced encryption and authentication methods. The unique identification number (UIN) and QR codes associated with e-invoices ensure that each transaction is traceable and verifiable. This transparency helps prevent fraudulent activities and protects both businesses and consumers from potential financial crimes.

8. Ease of Trade

E-invoicing simplifies international trade operations by providing a standardized and recognized format for invoices. This standardization reduces the complexities associated with cross-border transactions, such as differing regulatory requirements and documentation standards. Businesses engaged in international trade can benefit from quicker processing times and fewer barriers to conducting business globally.

9. Real-time Data Insights

The real-time nature of e-invoicing provides businesses with immediate insights into their financial transactions. This real-time data allows for better decision-making, as businesses can monitor their cash flow, outstanding invoices, and payment statuses instantly. Access to up-to-date financial information enables proactive management and helps businesses stay agile in a dynamic market environment.

10. Compliance with Government Regulations

E-invoicing ensures that businesses comply with government regulations and tax requirements. The automated validation process conducted by the LHDN reduces the risk of non-compliance and associated penalties. Businesses can operate with confidence, knowing that their invoicing practices adhere to the latest legal standards.

How Onnet Consulting’s e-Invoicing Solution Can Help Your Business

Onnet Consulting provides comprehensive e-invoicing solutions to help businesses in Malaysia comply with the new regulations. Our solutions offer seamless integration with your existing systems, ensuring efficient and accurate e-invoicing.

We provide support and training to help your team adapt to the new processes, minimizing disruption and maximizing compliance.

Onnet Consulting: e-Invoicing Solution Provider in Malaysia

e-Invoicing is a crucial step towards modernizing business operations and tax administration in Malaysia. With the 2024 guidelines in place, businesses must prepare for this transition.

Onnet Consulting offers tailored e-invoicing solutions to help your business navigate this change smoothly.

Contact us today to learn how we can support your e-invoicing needs and ensure compliance with the new regulations.